A demat account is a very important account. It is used widely for trading in ETF’s and stocks. The stock market has been moving towards paper trading for over a decade. One important aspect of it is that it does not bring stamp duty. A demat account has become a necessity for the investors. Without it, it poses a great hurdle to equity investing. Due to such scenarios, a great number of entities are switching to the dematerialized trading.

But what is demat account? Well, simply putting it, it means the account holds shares in electronic form. This makes it less messy without the paperwork and easy to transfer. The difference between a trading account and a Demat account is that a Demat account is used as a bank where shares are bought and sold.

Opening a demat account

If you are thinking of opening a demat account, well it’s quite simple. You can always open this account with almost any bank. It is also possible to open with brokers and financial institutions. It is preferably more beneficial to open a Demat account in a bank as banks offer attractive rates for demat accounts. But if you are an online stock trader, then it’s more convenient for you to open a Demat account with the same broker.

Easy steps to opening a Demat account

- Account opening form

To open a Demat account, the person has to fill in the account opening form. Alongside the form he will need to provide a copy of PAN card, photos and residential proof etc.

- Sign the agreement

In the agreement contains certain rights and regulations. The investors have to sign it and submit it to DP and the DP charges a particular fee. Then a copy of the signed agreement will be returned to the investors.

- Client ID

The client id will be provided by the DP once the investors open the depository account.

- Instruction slips

After providing the client ID, the DP would provide the account holder with the pre-printed instruction slips for the depository services. It is to be kept safe.

- Dead lines

Certain deadlines will be given to the account holder by the DP to give instructions for various depository services like transfer and purchase.

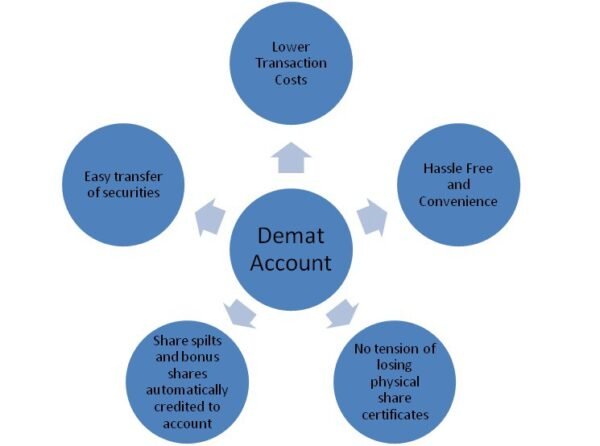

Benefits of opening a Demat Account

- It hugely minimizes the brokerage charges

- The brokers don’t face delivery problems.

- The brokers don’t have to face forgery.

- It significantly eliminates the risk of physical certificates like loss, theft or damage of certificates.

- The traders don’t require visiting the stock market repeatedly. They can operate from any place as the system is electronic.

Demat account is mandatory if you want to invest or trade in stock market. One can contact the broking houses or banks for opening the account. But you need to choose the broking house wisely. Check for the services they are offering and then make a comparison with others to reach the final conclusion.